Form 940 Instructions

Form 940 is an IRS tax form used to report Federal Unemployment Taxes(FUTA). Employers who pay federal unemployment taxes must file this form on an annual basis. These taxes are specific to employers; no unemployment taxes are deducted from their employees' wages. Here's a summary of the Form 940 instructions for the 2023 tax year.

What's New in the IRS Form 940?

IRS Form 940 updates include changes for credit reduction states. Employers in California and New York face a 0.6% credit reduction rate, while the U.S. Virgin Islands has a 3.9% rate, increasing their FUTA taxes due to unpaid federal loans for unemployment benefits.

Want to file Form 940?

Get Started Today with TaxZerone and file your 940 in a few simple steps. You will get instant IRS approval.

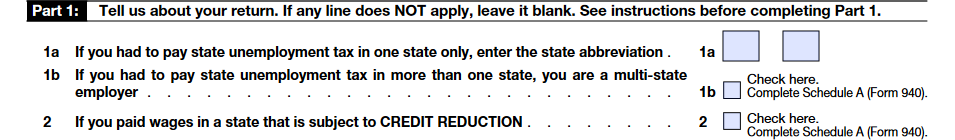

Part 1: Information about the return filed

In Part 1 of the 940 Form, you must provide some basic information about your return. Leave any lines that do not apply to your business blank.

- On-Line 1a, indicate if you are an employer who has only paid unemployment taxes in one state. Enter the abbreviation for this state.

- On-Line 1b, indicate whether you paid unemployment taxes in more than one state. This indicates that your company is a multi-state employer and must complete and attach 940 Schedule A.

- On-Line 2, indicate whether you paid wages in a credit-reduction state. For the 2023 tax year, the credit reduction states are California, New York and the US Virgin Islands.

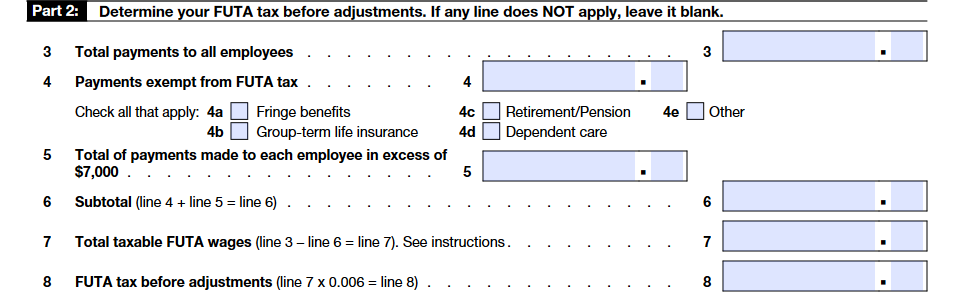

Part 2: Determining the FUTA tax before adjustments

In Part 2 of Form 940, you will calculate your FUTA tax before any adjustments. Again, skip any lines that do not pertain to your business.

- On-Line 3, enter the total payments made to all of your employees, even if some of them are not subject to FUTA taxes.

- On-Line 4, list any payments that are exempt from FUTA tax. For example, the payment does not meet the concept of wages. Check each of the following that apply:

- Fringe benefits (4a)

- Group-term life insurance (4b)

- Retirement/Pension (4c)

- Dependent care (4d)

- Other (4e)

- On-Line 5, enter any payments paid to an employee that exceed $7,000. The FUTA wage base is $7,000, which means that any sum above that is not subject to FUTA taxes. Subtract any payments exempt from FUTA taxes from this total.

- On-line 6, the subtotal. Add the amounts from Lines 4 and 5, then enter the total on Line 6.

- Line 7 represents the total taxable FUTA wages. To calculate this amount, subtract Line 6 from Line 3.

- Line 8 is the FUTA tax before modifications; multiply Line 7 by 0.006 to calculate this amount.

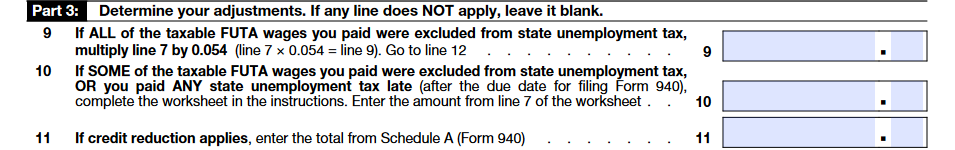

Part 3: Calculating the adjustments

In Part 3, you will make your adjustments. Only fill out the lines that apply to your business.

- Complete Line 9 if all taxable FUTA wages were exempt from state unemployment taxes. To achieve this, multiply line 7 by 0.054 and insert the result here.

Then you can go to Part 4. - Complete Line 10, some of the taxable FUTA salaries, were exempt from state unemployment taxes. You should also fill out Line 9 if you paid any state unemployment taxes late.

- If a credit reduction applies, complete Line 11. Please enter the total from Schedule A here.

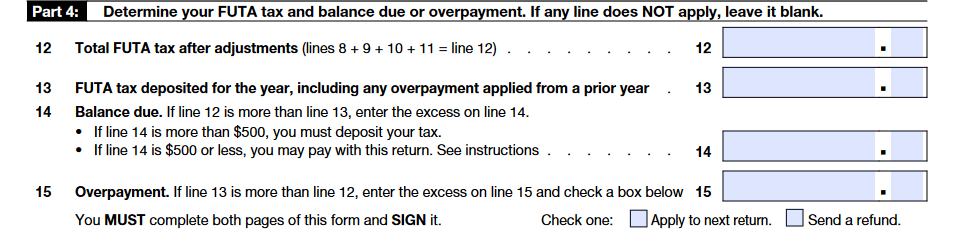

Part 4: Determine the FUTA tax and the balance due or overpayment

In Part 4, you will be determining your FUTA tax balance due and if you overpaid.

- Line 12 equals the total of lines 8, 9, 10, and 11. If the amount on Line 9 is more than zero, Lines 10 and 11 must be zero.

- Line 13 is where you will enter your FUTA deposits for the year. Include any overpayments made in the previous year.

- Line 14 is where you'll calculate the balance due. If the amount on Line 13 is less than that on Line 12, enter the difference.

If Line 13 is more than Line 12, enter the difference on Line 15, which represents the overpayment. Check the box to apply the overpayment to a future return or to get a refund.

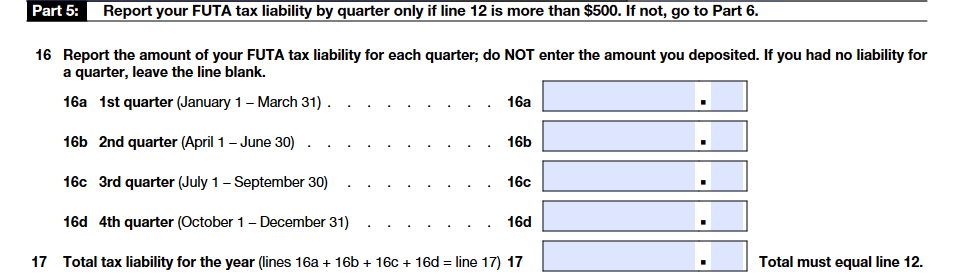

Part 5: Report FUTA tax liability if after adjustment is more than $500

You only need to complete Part 5 of Form 940 if the amount you entered on Line 12 is $500 or more; otherwise, skip to Part 6.

- Line 16: Enter your FUTA liabilities for each quarter.

- 16a (Q1)

- 16b (Q2)

- 16c (Q3)

- 16d (Q4)

- Other (4E)

- In Line 17, calculate the total FUTA liability for the year by adding the amounts from each quarter.

Use these Form 940 instructions to easily file Form 940.

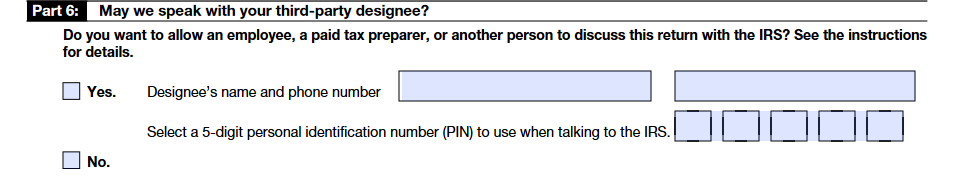

Third-party designee and Signing information

Now it is time to e-sign Form 940.

What is the mailing address for Form 940?

Although e-filing is the IRS' preferred method of filing Form 940, physical copies will be accepted. If you plan to file a paper copy, please select the address below that corresponds to your business location.

| 940 Mailing Address | Without a payment | With a payment |

|---|---|---|

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0046 | Internal Revenue Service P.O. Box 806531 Cincinnati, OH 45280-653 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0046 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| Puerto Rico, U.S. Virgin Islands | Department of the Treasury P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932000 Cincinnati, Louisville, KY 40293-2000 |

| If the location of your legal residence, principal place of business, office, or agency is not listed | Department of the Treasury P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

E-filing Form 940 with TaxZerone is simple and effective. We simplify the e-filing process by including auto calculation, error checks against IRS business standards, and required worksheets.

Choose TaxZerone to file Form 940.

TaxZerone makes it easier to e-file Form 940 with these 940 instructions. File using TaxZerone before the deadline and submit it to the IRS.

To e-file Form 940 for Tax Year 2023, follow the simple procedures outlined below.

- Create your free TaxZerone account!

- Select "Form 940" and enter the information.

- Review and send Form 940 to the IRS.